광고 및 협찬 문의

beltjolaman@gmail.com

광고 및 협찬 문의

beltjolaman@gmail.com

![[EN] The Real Reason You Can't Save Money: Where Financial Growth Begins image](https://beltjolaman.com/wp-content/uploads/2025/08/image-39.png)

“No matter how much I save, my bank account stays the same…”

“I make money, but nothing ever seems to be left over.”

Sound familiar?

Most people assume the problem is poor spending habits.

But the truth goes deeper.

The real reason you can’t save money isn’t just about expenses — it’s about structure.

Many people save what’s left at the end of the month.

But that’s a trap. It rarely works.

Why?

👉 Because spending always finds a way to expand.

There’s always one more bill, one more birthday gift, one more delivery app.

📌 Real financial planning starts with “Save first, spend later.”

– Set up auto-transfer right after payday

– Live on what’s left, not the other way around

Vague goals lead to weak results.

Saying “I should save more” isn’t a plan — it’s a wish.

👉 Money needs a purpose. That purpose gives it direction.

The more specific the goal,

💡 the more savings feel like an investment in your future, not a sacrifice.

Behind the phrase “I can’t save” is often this mindset:

👉 “Income is fixed, so my only option is to cut spending.”

But wealth doesn’t come from restriction — it comes from expansion.

True financial growth happens when you grow income, not just manage it.

Without a second engine of income,

saving feels like a grind that never ends.

Many people don’t track their finances at all.

Or they’re afraid to look.

👉 If you don’t look at your numbers, you can’t make a real plan.

Start with a simple budget app or spreadsheet.

Seeing your numbers clearly is half the battle.

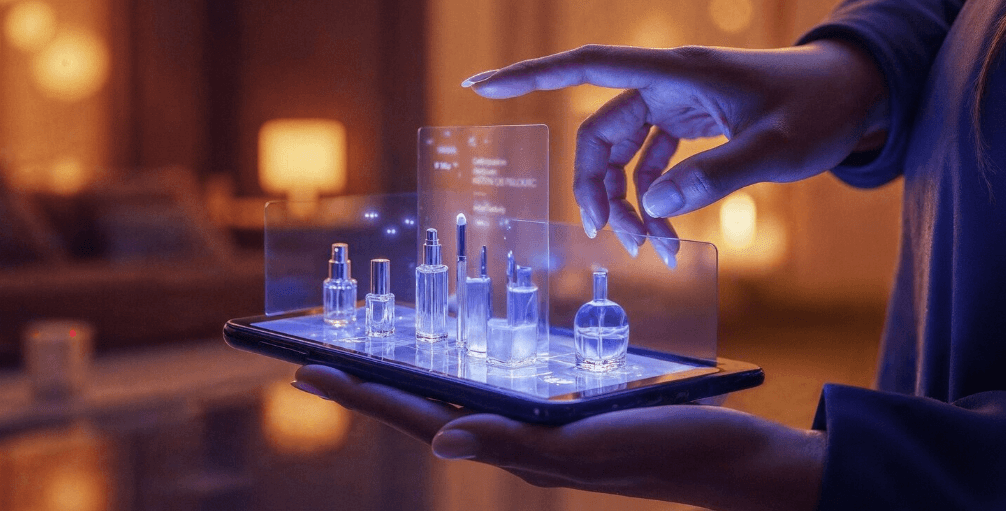

People often think financial growth starts with stocks, real estate, or ETFs.

But the real foundation is much simpler:

📌 Get this part right — and everything else starts to work.

Are you saving what’s left over?

Or are you saving first, and spending what’s left?

구독을 신청하면 최신 게시물을 이메일로 받아볼 수 있습니다.