광고 및 협찬 문의

beltjolaman@gmail.com

광고 및 협찬 문의

beltjolaman@gmail.com

![[EN] Jensen Huang Hints at China Market – 3 Takeaways for Korea image](https://beltjolaman.com/wp-content/uploads/2025/08/image-37-1024x677.png)

“Is AI Chip Dominance Shifting Back to China?”

– 3 Key Takeaways for Korean Investors

On August 27, 2025,

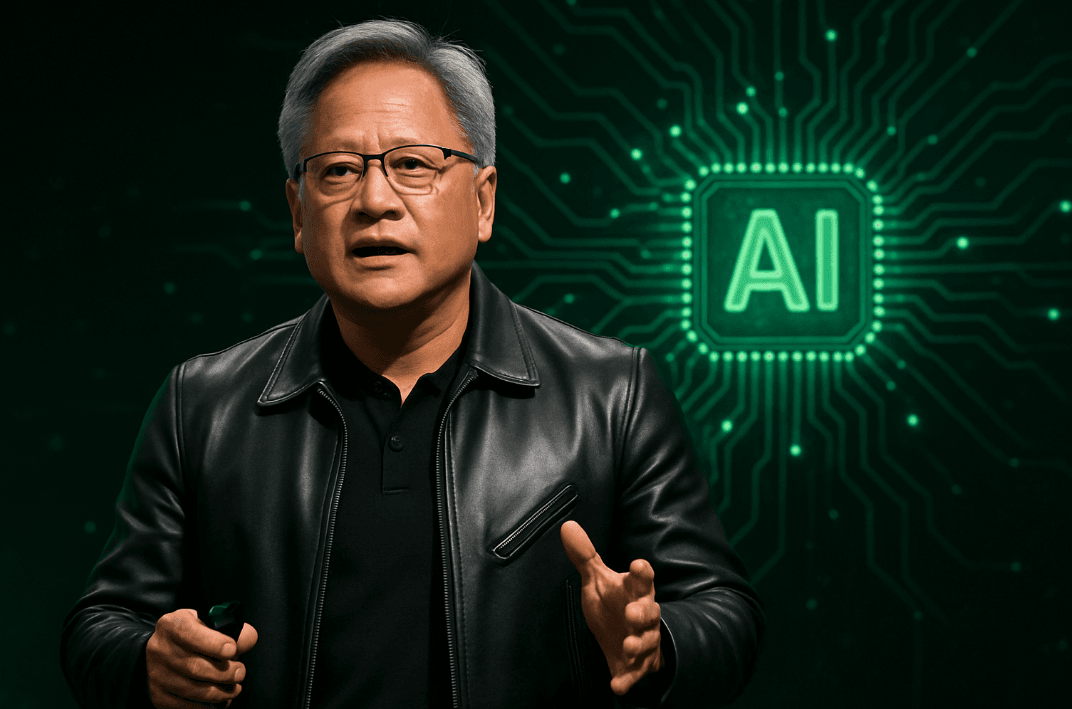

Jensen Huang, CEO of Nvidia and a key player in the global AI chip market,

made a statement that sent ripples through geopolitics and tech sectors alike:

👉 “There is a real possibility that we could launch our Blackwell (B100) AI chips in China.”

This one sentence has huge implications — for chip supply, AI development, and U.S.–China trade dynamics.

In its Q2 earnings report, Nvidia revealed that it had sold zero units of its H20 AI chips in China.

Still, total revenue for the quarter soared to $54 billion, up 56% YoY — an incredible feat.

Then Huang dropped the comment:

“There is a real opportunity to bring Blackwell to the Chinese market.”

This possibility stems from an evolving deal with the U.S. government,

reportedly allowing exports in exchange for a 15% revenue share to the U.S. government.

President Donald Trump had initially called Blackwell

“a missile-level technology” and stated he wouldn’t allow exports.

However, he later opened the door to a “softened” version of Blackwell for China.

Just like the throttled H20 chip,

we may soon see a Blackwell variant tailored for the Chinese market — with export-compliant specs.

This is more than just an “Nvidia earnings” headline.

👉 It’s a major development for Samsung, SK hynix, and Korean AI chip stocks.

Samsung is currently supplying HBM for Blackwell GPUs,

while SK hynix is a major player in the high-bandwidth memory (HBM) space.

So Nvidia’s return to the Chinese market

could directly affect Korean chip exports and AI ETF performance.

If Nvidia resumes chip sales to China,

it could lead to explosive short-term growth in global AI infrastructure.

However,

geopolitical tensions between the U.S. and China may quickly escalate in response.

For Korean investors and companies,

this is not just global news — it’s a signal to assess:

📌 Export opportunities

📌 Tech landscape shifts

📌 Geopolitical risk factors

…all of which matter for portfolio strategy and long-term positioning.

🔗 Source: CNBC (August 27, 2025)

Title: Nvidia’s CEO says there’s ‘real possibility’ it could sell Blackwell chips in China

구독을 신청하면 최신 게시물을 이메일로 받아볼 수 있습니다.